uber eats tax calculator canada

Regardless of whether the driver earns at least 100000 in revenue per year or if it is deemed to be a small supplier by CRA a driver can still get a license. Get help with your Uber account a recent trip or browse through frequently asked questions.

Become A Rideshare Driver In Your City Uber

All you need is the following information.

. Get Uber Pass benefits by paying an additional 5 on Members orders. Common tax deductible expenses for food delivery drivers include. Check out rSkipTheDishes some useful information there.

It only takes a few minutes to register online and youll have your GSTHST number instantly. In Canada when you drive with Uber you are considered self-employed or an. You are responsible to collect remit and file sales tax on all your ridesharing trips to the Canada Revenue Agency CRA.

25 total fee for delivery orders. If you are currently driving an Uber then this video will show you how to correctly report your income and expenses in your tax return. If you want to get extra fancy you can use advanced filters which will allow you to input.

Follow the step-by-step instructions to register. The 124 percent of this tax is for Social Security and the rest 29 percent is for Medicare. Certain states have implemented lower reporting thresholds.

Learn more on irsgov. If youre a food delivery driver you must have an ABN but you do not have to register for GST. Uber Eats Taxes are based on profits.

They report different income than what was deposited in your bank account and the uber tax summary can be confusing. This applies to earnings on both Uber rides and Uber Eats. Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters.

Your 1099-K is an official IRS tax document that includes a breakdown of your annual on-trip gross earnings. Curated menu features dishes from the local spots you love. The Canada Revenue Agency requires every ridesharing driver to create a GSTHST account number which must be shared with Uber within 30 days of a first trip.

Every UBER driver must register with the Canada Revenue Agency and provide the agency with an HSTGST number. Its the same cashless payment as. When preparing and filing their tax returns uber drivers must complete a t2125.

For purposes of this tax calculator just use the total money you actually received from Uber for the year. Well send you a 1099-K if. Your car expenses can reduce your taxable income by thousands.

If you completed your deliveries by car you may be able. If you enjoyed make. Prepare a self-employed income tax return steps 1.

Driving for a rideshare app requires you have a GSTHST number from Day One. Your bike and accessories if you deliver by bike instead of car A portion of mobile phone expenses. This number reflects the irss 56 cents per mile minus your fuels costs.

What Uber Eats paid you and what they say they paid you are two different numbers. The local tax rate in Ontario is 13. You may have heard that Uber drivers must register for GST but that tax law only applies to taxis who drive passengers not food.

The following table provides the GST and HST provincial rates since July 1 2010. The rate you will charge depends on different factors see. Being a driver for a rideshare app has different tax implications than being a courier for a food.

As a food delivery driver normal tax rules apply and you only need to register for GST if you earn more than. Get contactless delivery for restaurant takeout groceries and more. Our mid-cost plan to help businesses get discovered by new customers.

How To File Uber Tax Return Canada. Create an accountYou need to create a tax profile after your initial one has been processedCompleting the Income Information is Step 3Form T2125 should be completed in step 4Review the Bottom Line as part of Step 5The next time I go shopping let me tell you what a. If the delivery app charges a commission you can typically deduct the fees paid to the platform.

Normally your income tax is automatically deducted from the earnings you make throughout the year and summarized in a T4 slip thats issued to you by your employer. If you work for a ridesharing app like Uber and Lyft all your earnings are taxable and its recommended you put 25 of your income aside for the taxman. UberEATS delivers the best food right when you want it.

It should be the income on that list HST bottom of the list the referrals no HST from the top right of the sheet. One thing to understand is that Uber Eats does their tax documents like 1099 forms kind of funny. You simply take out 153 percent of your income and pay it towards this tax.

The provincial tax rate is 5. And the ones youve always wanted to try. When you report Gross income including GST.

In accordance with the rules and regulations outlined by the Canada Revenue Agency CRA Uber drivers Uber Eats Lyft Skip the dishes or other ride-sharing drivers are self-employed and are required to file their Canadian income taxes as being self-employed. Keep in mind that this HST was not calculated on the Tips that are included on the top list not it should be. Where the supply is made learn about the place of supply rules.

Who the supply is made to to learn about who may not pay the GSTHST. Order food online or in the Uber Eats app and support local restaurants. Your business will be shown in the home screen and search results of the Uber Eats app.

The self-employment tax is very easy to calculate. 10 total fee for pickup. Uber Eats Tax Calculator Canada.

Therefore you might receive a 1099-K for amounts that are below 20000. Find the best restaurants that deliver. Type of supply learn about what supplies are taxable or not.

As a Canadian youre required by the Canada Revenue Agency CRA to file income taxes every year. We are taxed as small business owners. The list of income on the Uber sheet is before HST.

Using our Uber driver tax calculator is easy. For example if your taxable income after deductions is 35000 you will pay 5355 in self-employment taxes. Here are the 9 important concepts you need to know about taxes as an Uber Eats delivery contractor.

The average number of hours you drive per week. That means that in addition to the usual income tax forms the Income Tax and Benefits Return you. The city and state where you drive for work.

Your average number of rides per hour.

Become A Rideshare Driver In Your City Uber

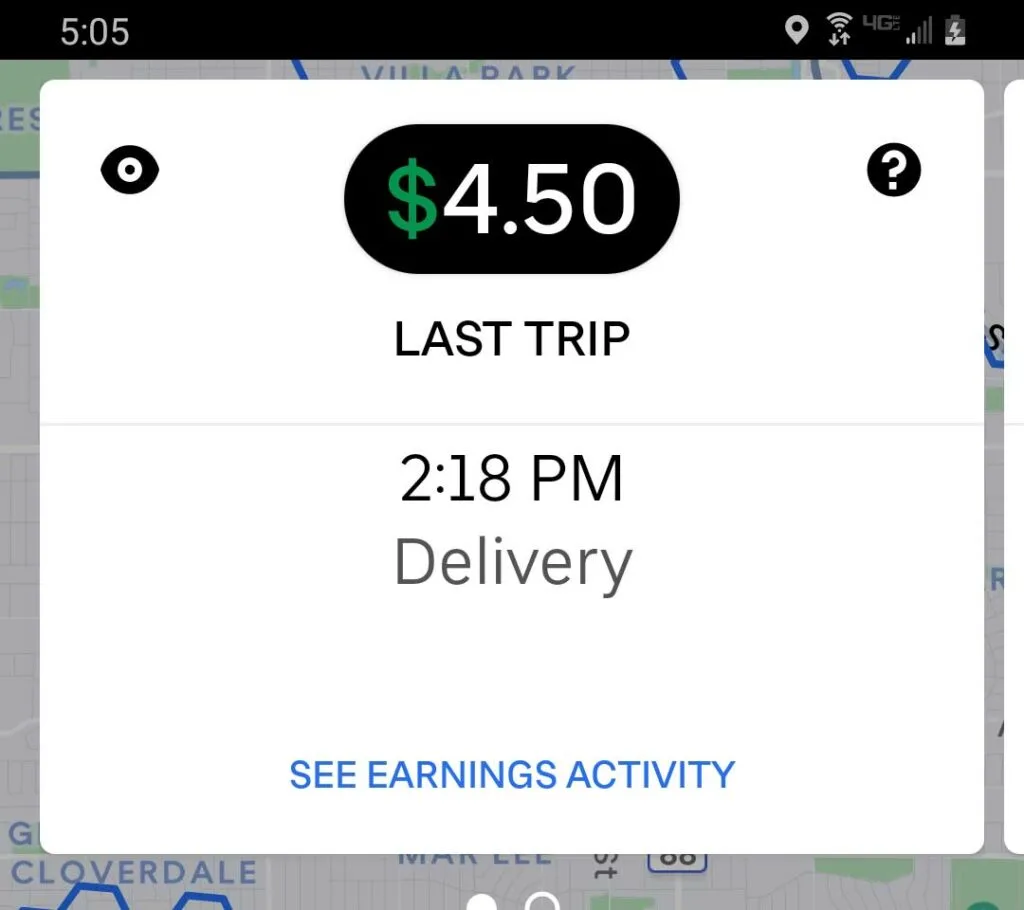

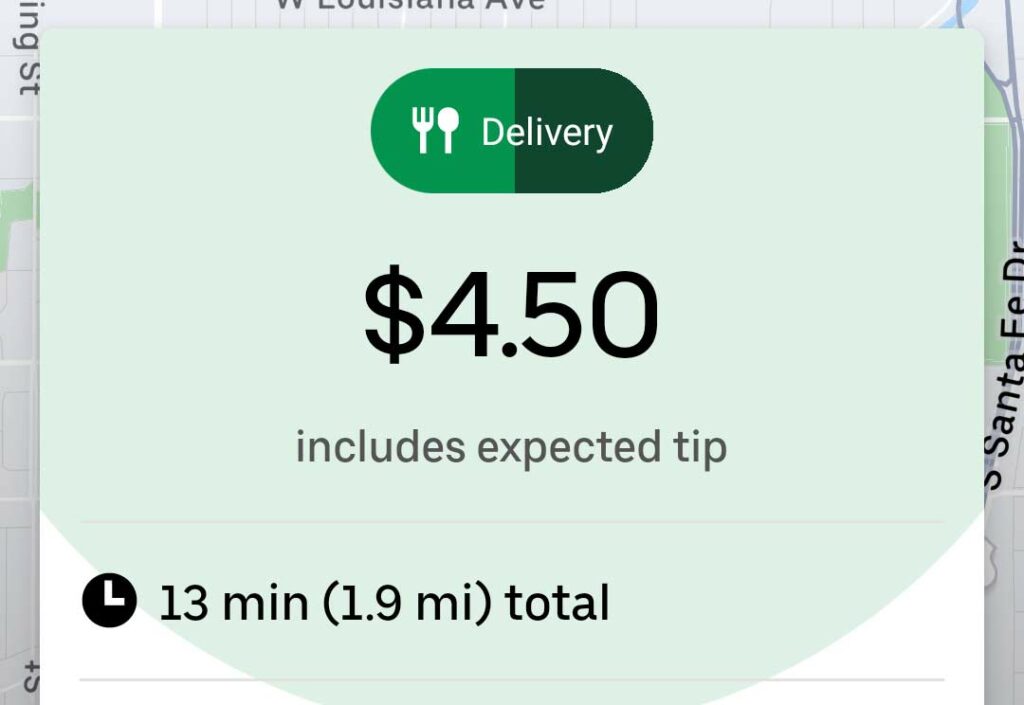

How Uber Eats Is Hiding Part Of The Tip And Then Blatantly Lying About It

How Much Uber Eats Drivers Earn Gig Drivers Of Canada

Become A Rideshare Driver In Your City Uber

Doordash Vs Ubereats Which Is Best For Drivers

Become A Rideshare Driver In Your City Uber

Uber Tax Summary Information For Driver Partners Uber Uber Blog

How To Report Income From Uber In A Canadian Tax Return Youtube

What Is A Rollover Ira How To Transfer Funds From Your 401 K To An Ira And Avoid Taxes Rollover Ira Ira Investment Changing Jobs

Trends In Apartment Renting Infographic Rent Infographic Infographic Rental Property Management

Become A Rideshare Driver In Your City Uber

Tracking Your Earnings Driver App Uber

Do Ubereats Drivers Pay Tax In Canada Ictsd Org

How Much Do Uber Eats Drivers Make Ridester Com

How Uber Eats Is Hiding Part Of The Tip And Then Blatantly Lying About It

Ubereats Requirements Seattle Guide To Car Requirements And Pay Seattle Map Seattle Delivery Driver

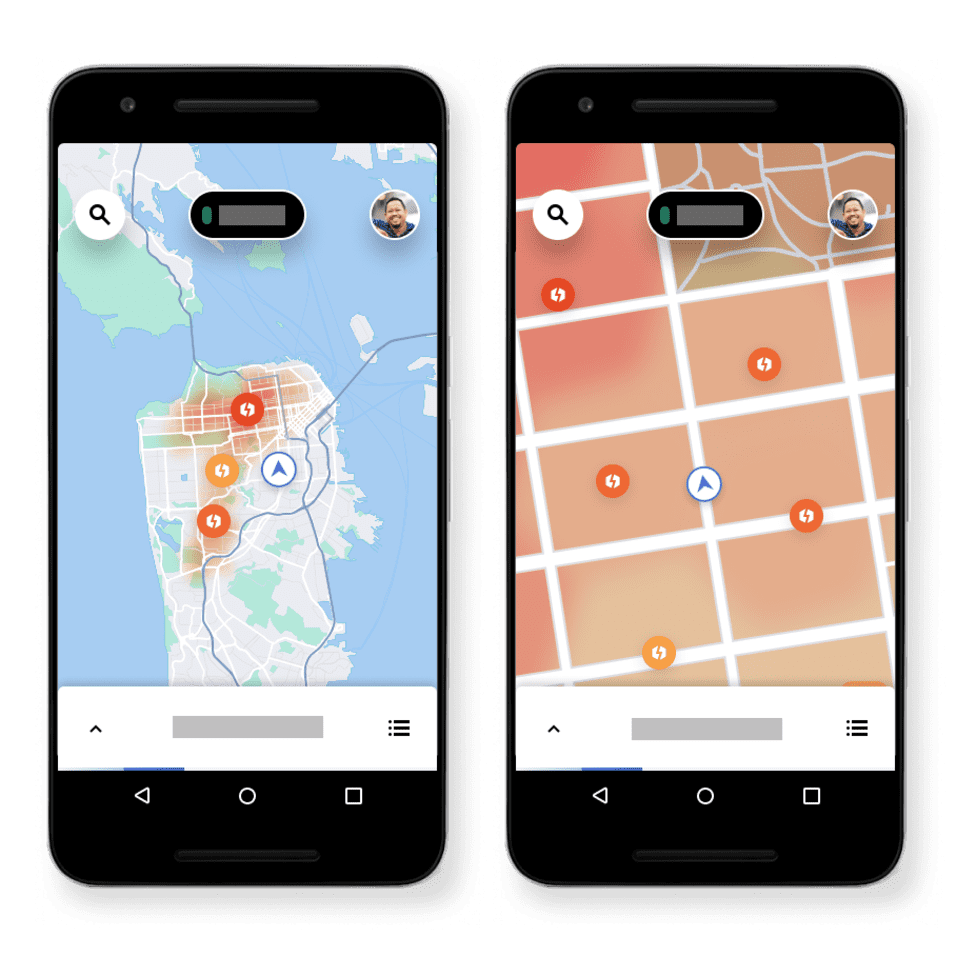

How Surge Pricing Works Drive With Uber Uber

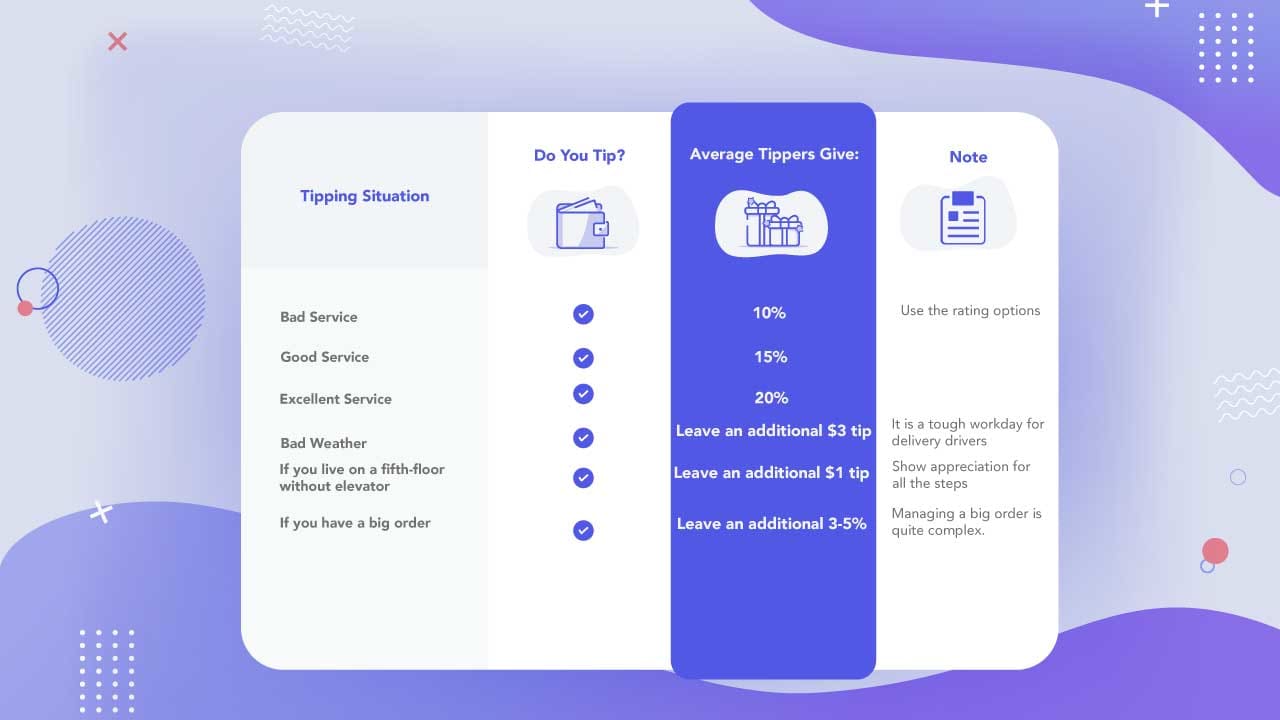

Do Uber Eats Drivers See Your Tip When You Order Food Online

How Uber Eats Is Hiding Part Of The Tip And Then Blatantly Lying About It